new orleans sales tax percentage

2021 List of Louisiana Local Sales Tax Rates. Never bid less than 100 ownership just.

New Orleans Louisiana S Sales Tax Rate Is 9 45

2021 List of Louisiana Local Sales Tax Rates.

. Sales Tax 1300 Perdido St RM 1W15 New Orleans LA 70112. With local taxes the total sales tax rate is between 4450 and 11450. All property tax bills for 2022 have been mailed and are also available online.

The city issues the winning bidder a tax sale certificate who becomes the tax sale purchaser and holds a tax sale title. Lowest sales tax 445 Highest sales tax 1295 Louisiana Sales Tax. The bidder who offers the least percentage of ownership wins.

The 2018 United States Supreme Court decision in South Dakota v. This includes the rates on the state county city and special levels. New Rate Effective on all renewals on and after 1212019.

This is the total of state parish and city sales tax rates. Revenue Information Bulletin 18-019. Within New Orleans there are around 51 zip codes with the most populous zip code being 70122.

What is the sales tax on food in New Orleans. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. Table of Sales Tax Rates for Exemption for the period July 2013 June 30.

Yes sales tax is required on all food items. For more information on the FQEDD sales tax call the City of New Orleans. The City of New Orleans sales tax rate on renting of any sleeping room will increase from 4 to 5.

Average Sales Tax With Local. Select the Louisiana city from the list of cities starting with N below to see its current sales tax rate. The Louisiana sales tax rate is currently.

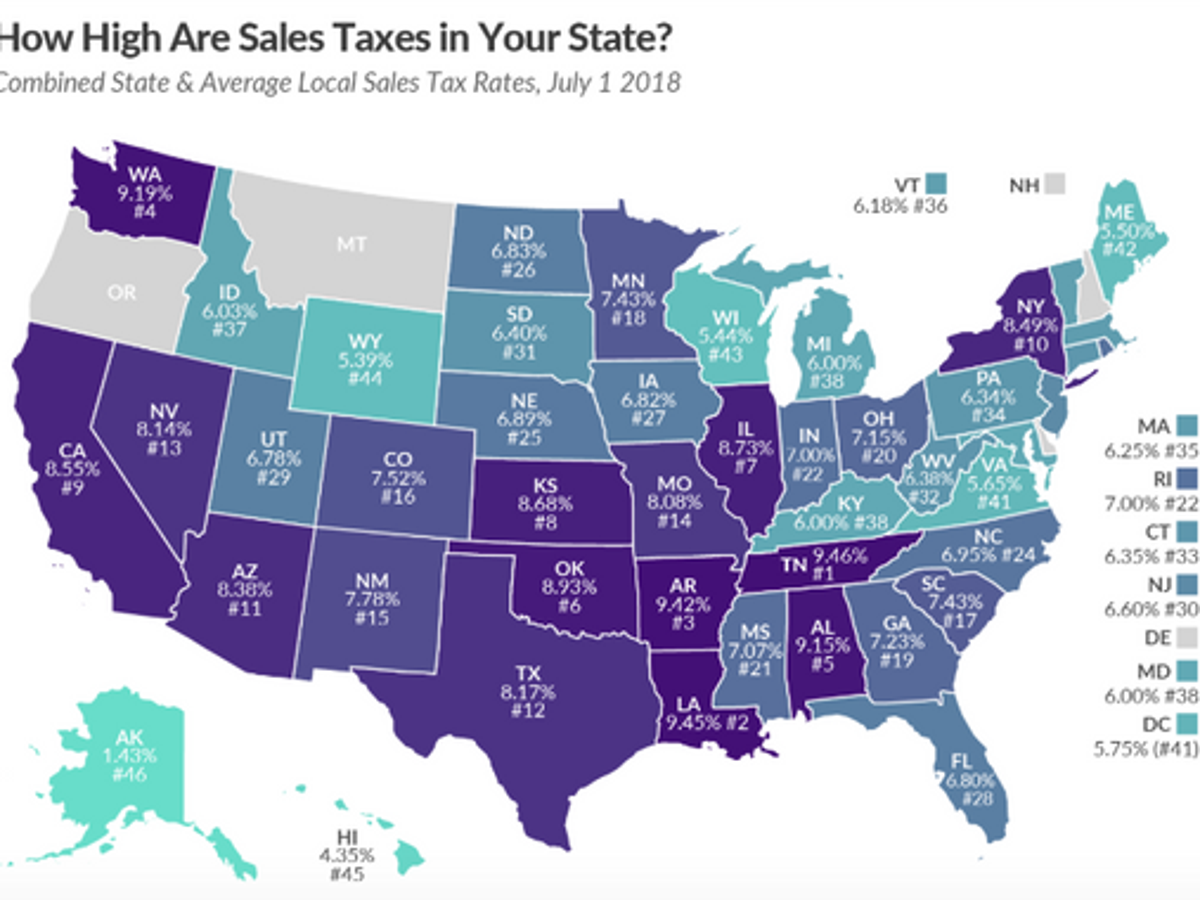

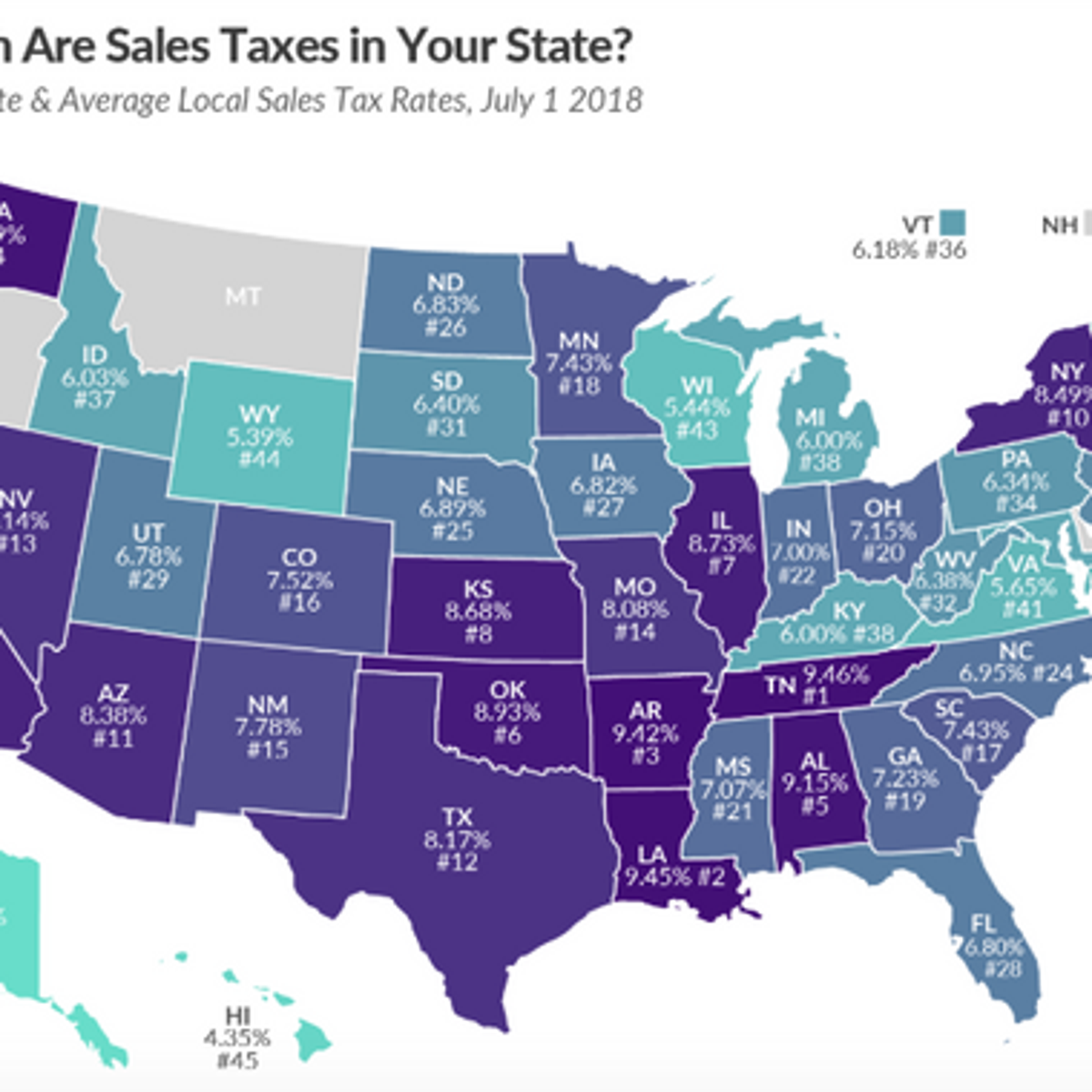

The five states with the highest average combined state and local sales tax rates are Louisiana 955 percent Tennessee 9547 percent Arkansas 948 percent Washington 929 percent and Alabama 922 percent. 150-874 of the City Code includes any establishment or person engaged in the business of furnishing sleeping rooms cottages or cabins to transient guests. All establishments are required to charge 5.

New Orleans has parts of it located within Jefferson Parish and Orleans Parish. There is no applicable city tax or special tax. Yes sales tax is required on all food items.

You can print a 945 sales tax table here. The reinstatement of a 0245 percent special sales tax levied in the French Quarter was approved by voters on the April 2021 special election ballot to authorize the funding of additional POST-certified officer patrols and other public safety programs in the area. The minimum combined 2022 sales tax rate for Orleans Parish Louisiana is.

520 rows 2022 List of Louisiana Local Sales Tax Rates. What is the sales tax rate in New Orleans Louisiana. In New Orleans Tax Sales are conducted by online auctions.

The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax. The price is set at the amount of taxes owed plus costs. The City of New Orleans today reminded residents the deadline for the 2022 property tax payments has been extended to March 15 2022.

How much is tax on food in New Orleans. Establishments in the City of New Orleans and the New Orleans airport must also regis-ter for collect and remit the EN. Orleans Parish in Louisiana has a tax rate of 10 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Orleans Parish totaling 6.

2 lower than the maximum sales tax in LA. Louisiana has recent rate changes Tue Oct 01 2019. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018.

You can find more tax rates and allowances for Orleans Parish and Louisiana in the 2022 Louisiana Tax Tables. Sales Tax provides a number of services for businesses and citizens in New Orleans. What is the sales tax rate in Orleans Parish.

Did South Dakota v. The New Orleans sales tax rate is. This is the total of state and parish sales tax rates.

The City of New Orleans tax rate is 5. Revenue Information Bulletin 18-017. Revenue Information Bulletin 18-019.

Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7. Delinquent payment penalties at the rate of 5 of the tax for each month or por-tion of month until the return is filed up to an aggregate. French Quarter EDD Imposed A New SalesUse Tax Rate at 0245 effective Beginning October 1 2021 Ending June 30 2026 Form 8010 Effective Starting July 1 2019 Present.

Louisiana has state sales tax of 445 and allows local governments to collect a. The City of New Orleans tax rate is 5. What is the sales tax in Louisiana 2021.

Which state has highest sales tax. What is the sales tax in Louisiana 2021. Parish E-File can pay City of New Orleans and State of Louisiana sales taxes together SalesTaxOnline.

Homeowners will have until March 15 to submit tax bill payments before interest accrues at 1 percent per month. The Louisiana state sales tax rate is currently. Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax.

The City of New Orleans tax rate is 5. Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax. For tax rates in other cities see Louisiana sales taxes by city and county.

The definition of a hotel according to Sec. The minimum combined 2022 sales tax rate for New Orleans Louisiana is. Table of Sales Tax Rates for Exemption for the period July 2013 June 30.

Revenue Information Bulletin 18-017. The average cumulative sales tax rate in New Orleans Louisiana is 943. The Orleans Parish sales tax rate is.

The Parish sales tax rate is. Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7. Restaurants Lounges and Nightclubs State of Louisiana.

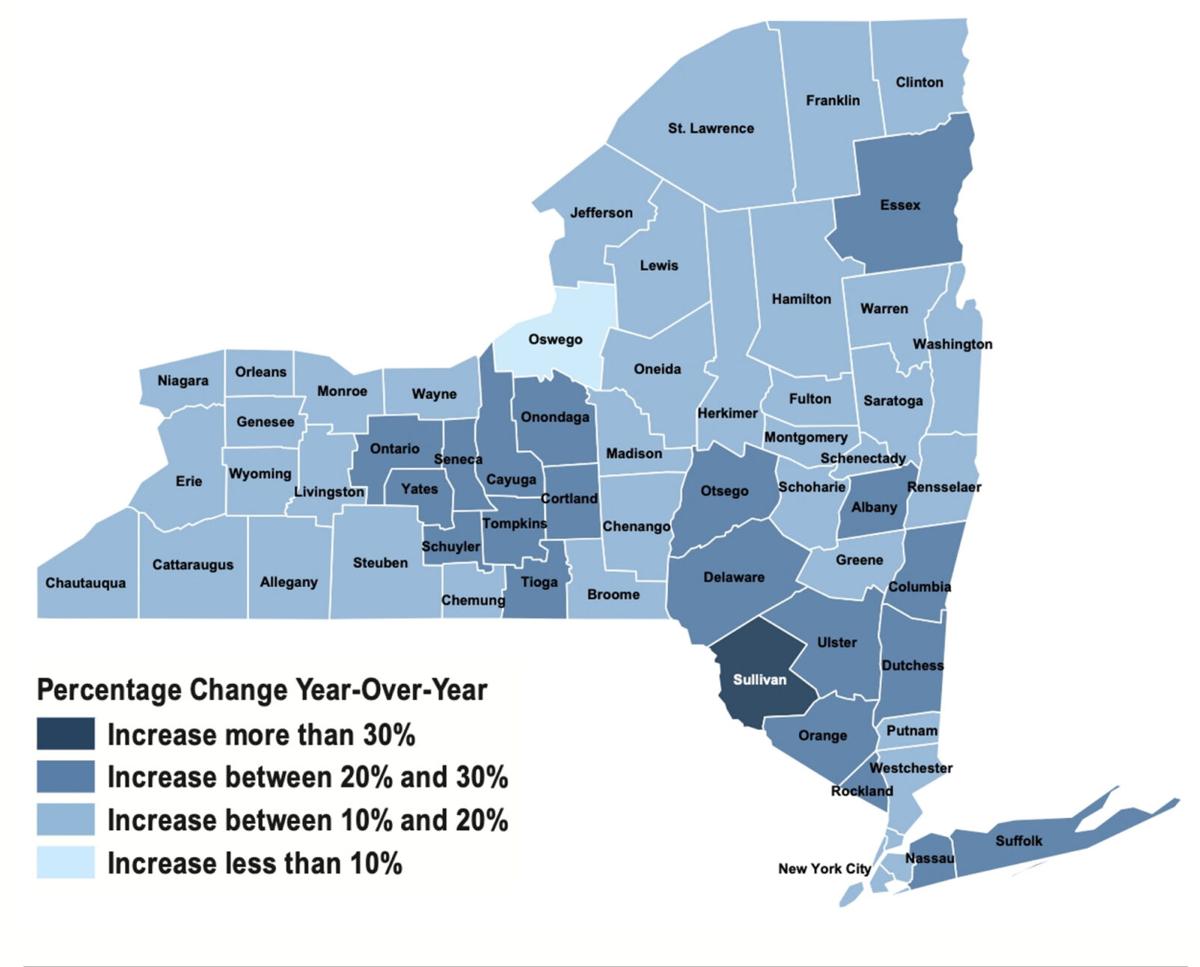

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com

Louisiana Sales Tax Small Business Guide Truic

Louisiana Vehicle Sales Tax Fees Find The Best Car Price

Which Cities And States Have The Highest Sales Tax Rates Taxjar

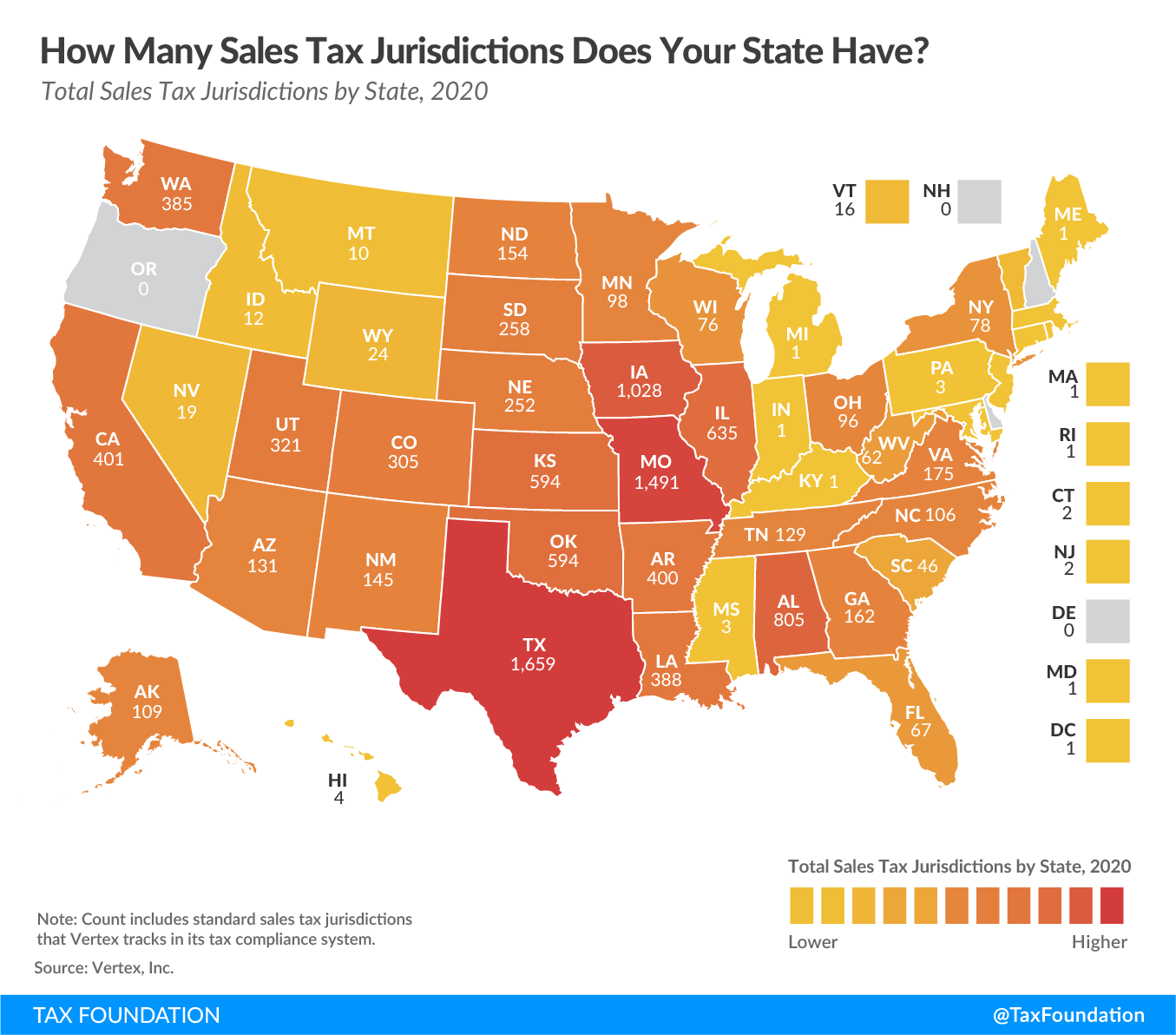

Internet Sales Taxes Tax Foundation

Infographic New Orleans Travel Surges

Louisiana Sales Tax Changes Laporte

Nevada Sales Tax Guide For Businesses

Minnesota Sales And Use Tax Audit Guide

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Sales Tax On Grocery Items Taxjar

File Sales Tax By County Webp Wikimedia Commons

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com